Frequently Asked

Questions

- Download the SBX App

SBX Android: https: //play.google.com/store/apps/details?id=ph.sbx.sbx

SBX IOS: https: //apps.apple.com/ph/app/sbx-stocks-by-seedbox/id6475809369 - Open the SBX app, review and accept the terms and conditions, fill in your details, and complete the mandatory eKYC process.

If no additional documents are required, you can fund your account immediately. Otherwise, please allow 1-2 working days for your account to be prepared for funding after registration.

Yes, the registration process is entirely online, offering convenience, time-saving, and the ability to complete it from anywhere, with quicker processing and easy access to updates.

| List of Valid IDs for Filipino Clients |

|---|

|

| List of Valid IDs for Foreign Nationals |

|

Currently, we do not accept applications for joint accounts. However, we plan to offer this option in the future. Please stay tuned for updates regarding joint account availability.

It includes the following steps:

- Fill up the necessary registration questionnaire

- Agree with the T&C, DP, OSTA, REIT Consent

- Front & back portion of your ID

- Signing your signature 3 times

- Taking a selfie

If your account is approved and EKYC (ID Upload, E-signature, and Selfie) is completed, you can fund your account within a few minutes.

If additional documents are requested, it may take 1-2 more days before you can proceed.

If additional documents are requested, it may take 1-2 more days before you can proceed.

You can upload additional requirements via the SBX App. Please ensure that the images you submit are clear, readable, and not blurred.

If you encounter any issues preventing you from sending them through the app, contact customercare@sbx.ph for assistance with your next steps.

If you encounter any issues preventing you from sending them through the app, contact customercare@sbx.ph for assistance with your next steps.

Certainly! We encourage non-Filipino citizens to open accounts with us and embark on your investing journey with SBX today.

Via EQ Trade

If you have any further questions, please don't hesitate to contact us at customercare@sbx.ph, we will keep you updated throughout the process.

- Contact SBX through customercare@sbx.ph to initiate the transfer process and obtain necessary forms and instructions.

- Please ensure that your account has sufficient funds to cover a Php 75 deduction.

- Fill out the Transfer Authorization Form provided by SBX, including details of the securities and delivering brokerage account.

- Send the completed and signed form for transfer to SBX through a courier service of your choice:

Address: 4/F Twin Cities Condominium, 110 Legazpi St.,

Legaspi Village, Brgy. San Lorenzo,

Makati City 1210, Metro Manila, PhilippinesContact Number: Tel. No. 8426 7952 - SBX will contact the delivering brokerage to facilitate the transfer, providing required information and documentation.

- The delivering brokerage will process the transfer request and coordinate with SBX to move the equity holdings to your new account. This typically takes a few days.

- Receive confirmation from both the delivering brokerage and SBX once the transfer is completed, along with a statement showing your transferred equity holdings in your new account.

If you have any further questions, please don't hesitate to contact us at customercare@sbx.ph, we will keep you updated throughout the process.

- Non-Filipino nationals can open an SBX account using any two valid identification documents.

- Alien Certificate of Registration (ACR)

- Passport

- You want to start your investment journey and thrive with SBX?

Download the SBX App through:

SBX Android: https: //play.google.com/store/apps/details?id=ph.sbx.sbx

SBX IOS: https: //apps.apple.com/ph/app/sbx-stocks-by-seedbox/id6475809369

| List of Valid IDs for Foreign Nationals |

|---|

Please inform the SBX team of any updates to your address, contact numbers, settlement accounts, or other details by emailing customercare@sbx.ph. We will promptly update your information in our system.

- Click Forgot password

- Type, Email Address, Add New password, and Confirm New Password

- Submit

- OTP will be sent via E-mail

- Enter the OTP

- Click Proceed

If you have any further questions, please don't hesitate to contact us at customercare@sbx.ph

Experience hassle free funding with SBX:

For both initial and additional funding, expect your payment to be credited within 1-2 working days.

Stay tuned as we work towards enabling real-time crediting for additional funding, ensuring a seamless trading experience.

For both initial and additional funding, expect your payment to be credited within 1-2 working days.

Stay tuned as we work towards enabling real-time crediting for additional funding, ensuring a seamless trading experience.

Mainly because the initial funding goes through the activation process, and the initial funding is also being verified.

Note: When your account is approved, it doesn't necessarily mean it is already activated. Initial Funding must be initiated first.

Note: When your account is approved, it doesn't necessarily mean it is already activated. Initial Funding must be initiated first.

Start your trading journey with SBX with just Php 500.

Enjoy a full trading experience with a lower initial investment compared to other platforms.

Enjoy a full trading experience with a lower initial investment compared to other platforms.

- Instapay: P15 fee

- Pesonet: P10 fee

- UnionBank: No fee/Free

Please note that some banks may charge an additional fee of Php 25 (subject to banks discretion).

Consider depositing a larger amount to avoid paying fees and maximize your investment. For lower fees, we recommend using UnionBank.

Yes, you may use a bank account under another person's name to fund your trading account, facilitating convenient investment opportunities.

However, for security reasons, withdrawals will be sent to the bank account you provided during registration.

However, for security reasons, withdrawals will be sent to the bank account you provided during registration.

| AllBank (A Thrift Bank), Inc |

| Asia United Bank Corporation |

| Bank of America, N |

| Bank of China (Hongkong) Limited-Manila Branch |

| Bank of Commerce |

| Bank of the Philippine Islands |

| BDO Unibank, Inc |

| BPI Direct BanKO, Inc |

| China Bank Savings, Inc |

| China Banking Corporation |

| CIMB Bank Philippines, Inc |

| Citibank, N |

| CTBC Bank (Philippines) Corporation |

| Deutsche Bank AG |

| Development Bank of the Philippines |

| Dumaguete City Development Bank, Inc |

| East West Banking Corporation |

| Equicom Savings Bank, Inc |

| GoTyme Bank Corporation |

| HSBC Savings Bank (Phils), Inc |

| JP Morgan Chase Bank, N |

| Land Bank of the Philippines |

| Malayan Savings Bank, Inc |

| Maya Bank, Inc |

| Maybank Philippines, Inc |

| Metropolitan Bank and Trust Company |

| Philippine Bank of Communications |

| Philippine Business Bank, Inc |

| Philippine National Bank |

| Philippine Savings Bank |

| Philippine Trust Company |

| Philippine Veterans Bank |

| Producers Savings Bank Corporation |

| Queen City Development Bank, Inc |

| Rizal Commercial Banking Corporation |

| Robinsons Bank Corporation |

| Security Bank Corporation |

| Standard Chartered Bank |

| Sterling Bank of Asia, Inc |

| The Hongkong & Shanghai Banking Corporation |

| Tonik Digital Bank, Inc |

| Union Bank of the Philippines |

| Union Digital Bank |

| UNObank, Inc |

| Wealth Development Bank Corporation |

Here’s how to buy a stock:

- Log in to your account

- Choose the equites you want to add to your portfolio

- Press “Buy”

- Input the details of your order

- Review and confirm your order

Here’s how to sell your stocks:

- Log in to your account

- Choose the equites you want to sell

- Press “Sell”

- Enter the order details

- Review and confirm your order

If you posted an order and wants to cancel the said order,

- Go to Portfolio Tab

- Click Order List Screen

- Click the said order you want to cancel

- Click Cancel Order

- Proceed

| Time | Market Window |

|---|---|

| 09:00 AM | Pre-open |

| 09:15 AM | Pre-open / No Cancellation Period |

| 09:30 AM | Market Open |

| 12:00 PM | Market Recess |

| 01:00 PM | Market Resumption |

| 02:45 PM | Pre-close |

| 02:48 PM | Pre-close / No Cancellation |

| 02:50 PM | Run-off / Trading-at-last |

| 03:00 PM | Market Close |

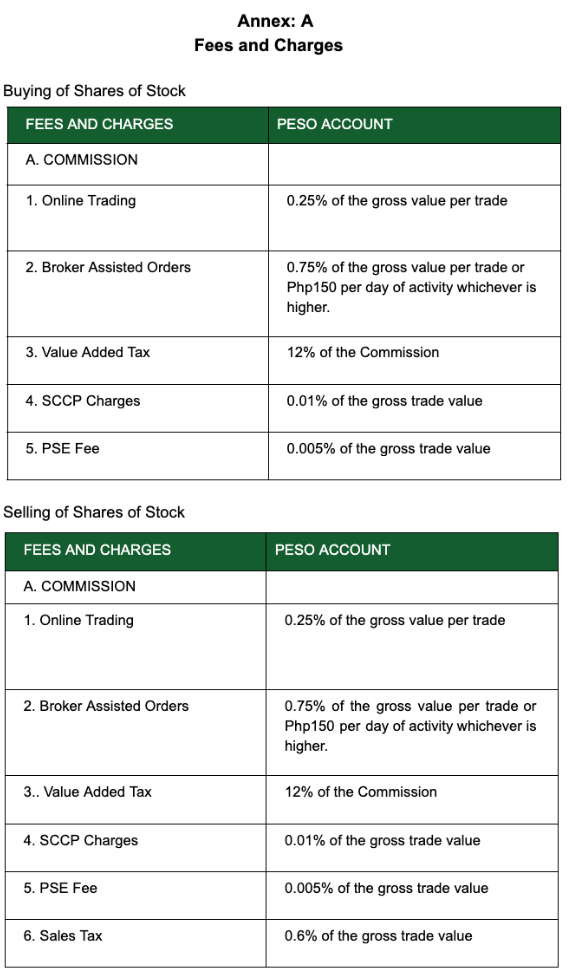

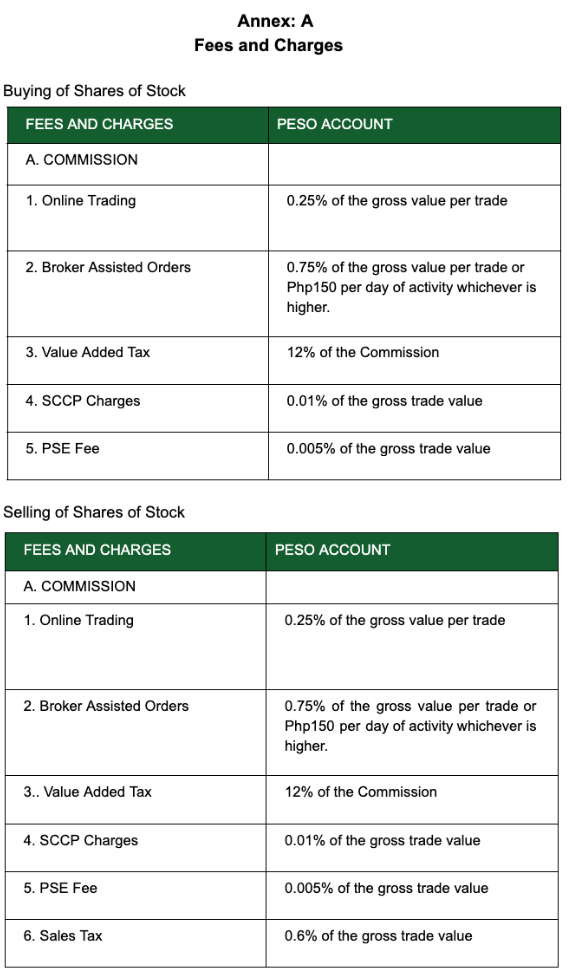

At SBX, we pride ourselves on offering some of the lowest fees available in the market. Our goal is to minimize friction costs for our clients, providing convenience and maximizing their profitability.

To unlock the exciting world of trading with SBX, you’ll need to deposit funds into your account first. Once your account is funded, you'll be ready to dive into the markets and start maximizing your profitability!

Currently, you cannot execute trades when the markets are closed. However, stay tuned with SBX as we are working on a feature that will allow you to place trades even after market hours.

- Limit Order- A limit order is a specific instruction to purchase or sell a stock, with a set limit on the highest price for buying or the lowest price for selling. If the order is executed, it will occur at the designated Limit Price or a better price.

- Conditional Order- A conditional order allows you to set specific conditions for buying or selling a stock. It triggers the order only when the stock's price meets your specified level or other criteria, like time or volume. You can use simple operators, like equal to, greater than, or less than, to define these conditions.

Equity: Equity refers to the ownership interest that shareholders have in a company. It is the difference between the company's total assets and total liabilities.

Bull Market: A bull market is a period of rising stock prices and overall optimism in the market. It is typically characterized by increased buying activity and positive investor sentiment.

Bear Market: A bear market is a period of declining stock prices and overall pessimism in the market. It is marked by increased selling activity and negative investor sentiment.

Index: An index is a statistical measure of the performance of a group of stocks representing a particular market or sector. Examples include the S&P 500, Dow Jones Industrial Average (DJIA), and Nasdaq Composite.

Volatility: Volatility refers to the degree of price fluctuations in a stock or the overall market. High volatility indicates significant price swings, while low volatility suggests more stable prices.

Bid and Ask: The bid price is the highest price a buyer is willing to pay for a stock, while the ask price is the lowest price a seller is willing to accept. The difference between the bid and ask price is known as the spread.

Market Order: An order to buy or sell a stock at the best available price in the market at the time the order is placed.

Limit Order: An order to buy or sell a stock at a specified price or better. For a buy limit order, the price must be at or below the specified limit price. For a sell limit order, the price must be at or above the specified limit price.

Stop Order (Stop-Loss Order): An order that becomes a market order once the stock reaches a specified trigger price. It is used to limit losses or protect profits.

Short Selling: Short selling is a strategy where an investor borrows shares and sells them with the expectation that the stock's price will decline. The investor aims to buy back the shares at a lower price to return them to the lender and profit from the difference.

Long Position: Holding a long position means owning stocks or securities with the expectation that their value will increase over time.

Day Trading: Day trading involves buying and selling securities within the same trading day, with no overnight positions.

Margin Trading: Margin trading allows investors to borrow funds from a broker to buy stocks, leveraging their buying power. It involves using margin accounts and carries higher risks.

Volume: Volume refers to the total number of shares or contracts traded in a security during a given period. High volume indicates active trading.

Bull Market: A bull market is a period of rising stock prices and overall optimism in the market. It is typically characterized by increased buying activity and positive investor sentiment.

Bear Market: A bear market is a period of declining stock prices and overall pessimism in the market. It is marked by increased selling activity and negative investor sentiment.

Index: An index is a statistical measure of the performance of a group of stocks representing a particular market or sector. Examples include the S&P 500, Dow Jones Industrial Average (DJIA), and Nasdaq Composite.

Volatility: Volatility refers to the degree of price fluctuations in a stock or the overall market. High volatility indicates significant price swings, while low volatility suggests more stable prices.

Bid and Ask: The bid price is the highest price a buyer is willing to pay for a stock, while the ask price is the lowest price a seller is willing to accept. The difference between the bid and ask price is known as the spread.

Market Order: An order to buy or sell a stock at the best available price in the market at the time the order is placed.

Limit Order: An order to buy or sell a stock at a specified price or better. For a buy limit order, the price must be at or below the specified limit price. For a sell limit order, the price must be at or above the specified limit price.

Stop Order (Stop-Loss Order): An order that becomes a market order once the stock reaches a specified trigger price. It is used to limit losses or protect profits.

Short Selling: Short selling is a strategy where an investor borrows shares and sells them with the expectation that the stock's price will decline. The investor aims to buy back the shares at a lower price to return them to the lender and profit from the difference.

Long Position: Holding a long position means owning stocks or securities with the expectation that their value will increase over time.

Day Trading: Day trading involves buying and selling securities within the same trading day, with no overnight positions.

Margin Trading: Margin trading allows investors to borrow funds from a broker to buy stocks, leveraging their buying power. It involves using margin accounts and carries higher risks.

Volume: Volume refers to the total number of shares or contracts traded in a security during a given period. High volume indicates active trading.

- Download the Withdrawal Request Form.

- Check available balance for withdrawal: Open your trading platform and navigate to the fund transfer section to view your available balance. Ensure the withdrawal amount does not exceed this balance, which represents the cash with SBX not used in the last 2 trading days.

- Fill out the form completely.

- Submit the signed and scanned copy of the Withdrawal Request Form to withdrawals@sbx.ph.

Download Withdrawal Request Form

- The minimum amount that can be withdrawn is P1,000.

- For withdrawals between P1,000 to P50,000 this will be done via Fund Transfer thru Instapay by SBX to the customer’s designated bank account. Fund transfer fees will be applied on every withdrawal transfer.

- For withdrawals above P50,000 this will be done through the issuance of a check which will be deposited to the customer's designated bank account.

- The desired amount must be equal to the cash available for withdrawal/cleared.

- Total turn-around time for the withdrawal process is 2 business days.

When you sell a stock, the money will go to your buying power, where you can use it to buy new stocks immediately or withdraw it. However, if you want to withdraw, you need to wait for 2 days before initiating the withdrawal from the proceeds of the selling.

Unionbank - Free

Instapay - P30

Pesonet - P25

Instapay - P30

Pesonet - P25

The minimum withdrawal amount is 1000 pesos.

It will take 2 working days to have the amount be reflected on your nominated settlement bank account.

No, the money you are withdrawing will go directly to your nominated settlement account that you provided during the registration process when you opened your account.

Yes, the check can be picked up in the office. Just specify it when you are sending the withdrawal request form.

Dividends from your stock holdings are automatically credited to your account a day after the Payment Date scheduled.

We send an email when there are upcoming IPOs. There's a link there where you can fill up a form to avail of the IPO. Then, you have to wait for our email confirmation if your IPO request has been granted.